do nh residents pay sales tax on cars

If Im buying a car in mass as a NH resident do i pay sales tax on that car. If a motor vehicle is casually sold not sold by a dealer or lessor the use.

If the vehicle will be registered in Allegheny County PAs 2 nd most populous county theres an added 1 local sales tax for a total of 7 sales tax on a.

. Yes regardless of where you live if you purchase a car in MA you must pay the 625 percent sales tax in MA within 10 days if youre going to register in MA or within 20 days. If youre getting it through a Massachusetts car dealer theyll know how do the paperwork. Ive personally experienced it.

Posted by udeleted 7 years ago. Would I have to pay sales tax on top of excise tax when I register it. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

In many states when a vehicle is registered sales tax is levied in the state of registry if it has not been paid at the time of purchase. When it comes down to Maines sales tax on cars youre only taxed on the 5000 credit not the 13000 you bought it for. The car dealer will follow the sales tax collection laws of their own state.

Buying a car in NH as a Maine resident. You can find these fees further down on the page. You will also need to provide proof that the vehicle was acquired via.

If so Max to either state. If you live in New Hampshire when you buy a car in Massachusetts you dont have to pay Mass sales tax. Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency.

We go to the registry for you. The Treasury Department wants the money regardless of the tax laws of the state where the vehicle was purchased. However you must complete the EPA Declaration Form Importation of Motor Vehicles and Motor Vehicle Engines Subject to Federal Air Pollution Regulations Form 3520-1 making sure you declare code M on it and hand this to US.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. Buying a car in NH as a Maine resident. This is tax evasion and authorities are cracking down on.

In addition to taxes car purchases in Maine may be subject to other fees like registration title and plate fees. If a NH resident buys a car in MA does he have to pay state sales tax to MANH. Do Nh Residents Pay Sales Tax on Cars.

Would I have to pay sales tax on top of excise tax when I register it. And not only will you not pay Vermont sales tax if you live in New Hampshire or Massachusetts we will take care of the paperwork necessary for you to purchase your vehicle here and get it back home. The use tax applies to all other types of transfers of title or possession where the vehicle transferred is stored used or consumed in Massachusetts.

If the sale is made by a motor vehicle or trailer dealer or lessor who is registered the sales tax rate is 625. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Answer 1 of 6.

February 11 2022 MEINSTYN. Do nh residents pay sales tax on cars Sunday April 24 2022 Edit. When buying cars in Florida Alabama residents pay only 2 Colorado residents pay 29 Hawaii and Wyoming residents pay 4 and Louisiana residents pay 5 sales tax.

This tax policy means residents of New Hampshire Delaware Montana Oregon and Alaska who find and buy their dream cars in Florida do not pay sales or use taxes in Florida. The majority of states45 and the District of Columbia as of July 2021impose a sales tax at the state level. The answer depends on whether the resident paid any sales tax to the state in which the vehicle was purchased.

We handle most states registration paperwork for you. Someone must have done this and have some inputadvise. Customs upon entry into New Hampshire.

If a resident purchases a vehicle in another state and registers it in Connecticut he or she is liable. Maine collects a 55 state sales tax rate on the purchase of all vehicles. Connecticut charges 635 sales and use tax on purchases of motor vehicles that CGS 12-4081A H and 12-4111A H.

That way you dont have to deal with the fuss of trying to follow each states. For vehicles that are being rented or leased see see taxation of leases and rentals. For more information on motor vehicle fees please contact the NH Department.

The answer is unequivocally no you will not have to pay Vermont sales tax when purchasing a car if you do not live in Vermont. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax. A 9 tax is also assessed on motor vehicle rentals.

You only pay tax in the state that you register the vehicle.

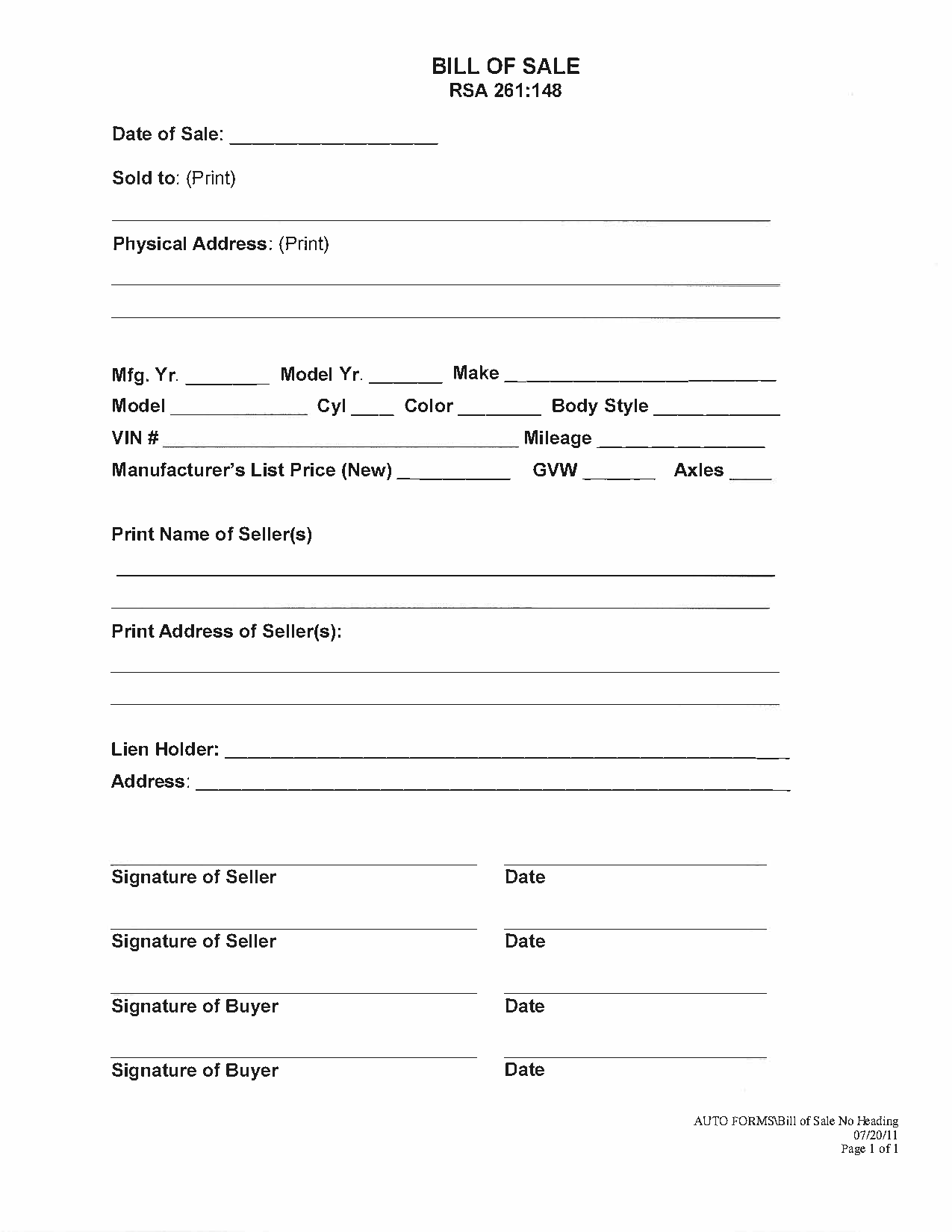

Free New Hampshire Motor Vehicle Dmv Bill Of Sale Form Pdf

New 2016 Lance 855s Truck Camper Fits 6 1 2 Bed Truck Camper Camper Slide In Truck Campers

Free New Hampshire Bill Of Sale Form Pdf Word Legaltemplates

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

When You Buy A Car From New Hampshire Is There Sales Tax Sapling

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

How To Buy A Car In Another State Tulley Mazda In Tulley Nh

Used Kia Sorento For Sale In Manchester Nh Edmunds

Nj Car Sales Tax Everything You Need To Know

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Buy Or Lease A New 2020 2021 Ford In Swanzey Nh Ford Dealership Near Manchester Nh

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Free New Hampshire Motor Vehicle Bill Of Sale Form Pdf Word

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price